Regfo: How AI Agents Are Solving the $100B Compliance Bottleneck

Regulatory compliance costs financial institutions over $206 billion annually. In pharma, 85% of experiments fail due to regulatory misalignment. These are not efficiency problems. They are existential threats to innovation. Regfo is the first AI platform purpose-built to transform compliance from a bottleneck into a continuous, auditable process.

The Problem: A $100 Billion Regulatory Bottleneck

The global RegTech market reached $18.6 billion in 2025 and is projected to hit $77 billion by 2034. This explosive growth signals a fundamental truth: organizations are drowning in compliance costs, and the existing solutions are not working.

The numbers tell a stark story across three critical industries.

Pharmaceutical: Where 85% of Experiments Die

The FDA has authorized over 1,000 AI-enabled medical devices, yet the drug development pipeline remains brutally inefficient. Here is the reality: 85% of pharmaceutical experiments fail not because the science is wrong, but because regulatory requirements were misunderstood from the start.

Consider what happens when a biotech company designs a clinical trial. The team must navigate ICH E6 guidelines, FDA 21 CFR Part 11 requirements, GxP standards, and constantly evolving EMA frameworks. Miss a single requirement in your study protocol, and months of work become worthless. The FDA's January 2025 draft guidance on AI in regulatory decision-making acknowledges this complexity but offers no automation pathway.

Traditional compliance approaches treat regulatory alignment as a final checkpoint. This is backwards. By the time a compliance officer reviews a study design, the team has already committed resources, hired CROs, and locked in timelines. Retrofitting compliance at this stage means restarting from zero.

Banking: Alert Fatigue and Missed Systemic Risks

Financial compliance presents a different but equally devastating challenge. Banks now face fragmented regulatory signals from FINRA, FDIC, the Basel Committee, FinCEN, and dozens of international bodies. The result is alert fatigue at scale.

According to FINRA's 2026 Regulatory Oversight Report, the financial industry generates millions of compliance alerts daily. Compliance teams, overwhelmed by volume, develop filtering habits that inevitably miss systemic risks. A 2024 study found that 67% of banks have lost clients due to slow KYC processes, up 19% from 2023. The annual cost of KYC reviews alone reaches $175 million for large commercial banks.

The irony is painful: compliance systems designed to reduce risk actually create new risks by overwhelming the humans who operate them.

M&A and Due Diligence: Where Speed Kills Accuracy

Mergers and acquisitions demand real-time regulatory due diligence across multiple jurisdictions. Existing tools, designed for static document review, cannot keep pace with deal timelines. When a pharmaceutical company acquires a biotech startup, compliance teams must simultaneously evaluate FDA submissions, European regulatory status, intellectual property encumbrances, and ongoing clinical trial obligations.

Current solutions force a choice between speed and thoroughness. Neither option is acceptable when billions of dollars and patient safety hang in the balance.

Why Generic AI Is Not Enough

The temptation to solve compliance problems with ChatGPT or Claude is understandable. These models can read regulations, summarize documents, and answer questions about legal requirements. But deploying general-purpose AI for regulatory compliance is like using a consumer GPS for aviation navigation: it might work most of the time, but the failures are catastrophic.

The Traceability Problem

Every compliance decision must be auditable. When an FDA inspector asks why a clinical trial included a specific patient population, the answer cannot be "the AI suggested it." Auditors require evidence trails that map conclusions directly to regulatory source documents.

General-purpose LLMs cannot provide this traceability. They generate plausible-sounding text based on statistical patterns, but they cannot prove their reasoning derived from specific regulatory clauses. Claude might accurately summarize FDA guidance, but it cannot cryptographically verify that its recommendations align with 21 CFR Part 312.23(a)(6)(iii)(a).

The EU AI Act, passed in 2024, now treats compliance AI as "high-risk," requiring companies to document how their models work, how they control for bias, and how results can be explained to auditors. Generic AI models were never designed to meet these requirements.

The Hallucination Risk

In 2025, studies confirmed what compliance professionals feared: large language models hallucinate at measurable rates, inventing citations, fabricating regulatory requirements, and confidently stating incorrect information. For a marketing email, hallucination is embarrassing. For a clinical trial protocol, hallucination can delay drug approvals by years or expose patients to unacceptable risks.

Compliance Alignment LLMs (CALLMs), a new class of models explicitly engineered for regulatory conformance, emerged precisely because general-purpose models cannot guarantee the accuracy levels compliance requires.

The Fine-Tuning Paradox

Some organizations attempt to fine-tune base models on regulatory documents. This approach improves domain knowledge but does not solve the fundamental problems. Fine-tuning teaches a model the language of compliance, but it does not create auditable reasoning chains or real-time regulatory data retrieval.

Research from the EXL Insurance LLM project demonstrated that fine-tuned models can outperform GPT-4 on domain-specific tasks by 30% in accuracy. However, even these specialized models require additional architecture to meet compliance requirements. Fine-tuning alone is necessary but insufficient.

The Regfo Solution: Specialist, Auditable AI

Regfo approaches regulatory compliance as a CI/CD problem. Just as modern software development integrates testing throughout the pipeline rather than bolting it on at the end, Regfo integrates compliance validation into every stage of product development, clinical design, and policy creation.

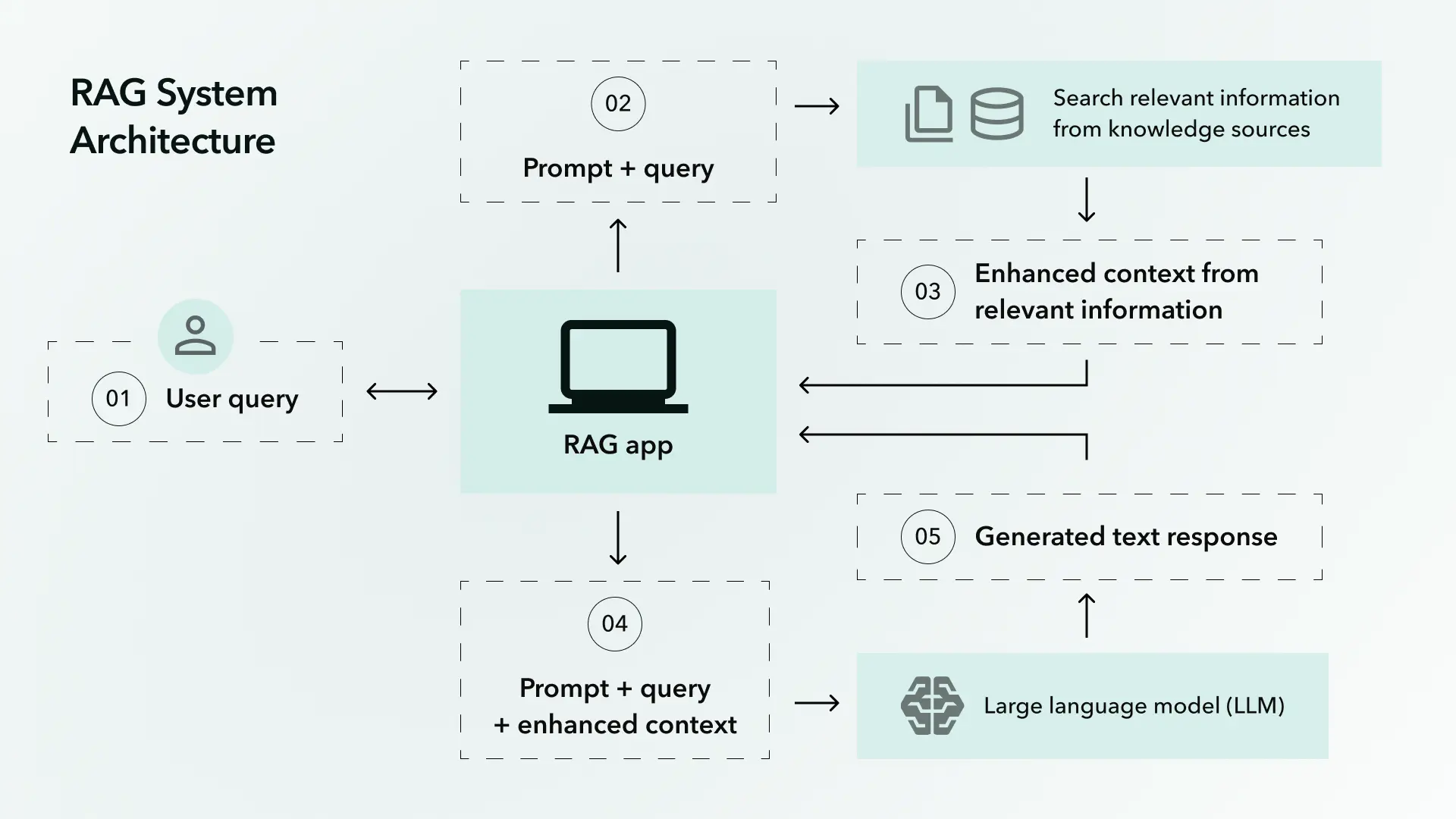

The platform rests on three architectural pillars: a semantic translation engine, a RAG-design pipeline with purpose-built templates, and cryptographically traceable evidence mapping.

Semantic Translation Engine

Regulatory documents are written in a specialized language that resists direct interpretation. The phrase "adequate and well-controlled studies" in FDA guidance has specific technical meaning that differs from its everyday usage. Regfo's semantic translation engine bridges this gap.

The engine maintains ontological mappings between regulatory concepts across jurisdictions. When a European pharmaceutical company prepares an IND submission for the FDA, the engine translates EMA-compliant documentation into FDA-expected formats, flagging divergences that require substantive changes rather than mere formatting adjustments.

This is not simple document conversion. The engine understands that European clinical endpoints may not satisfy FDA evidentiary requirements, that European patient consent frameworks differ from US IRB expectations, and that manufacturing documentation must address jurisdiction-specific concerns.

RAG-Design Pipeline with Purpose-Built Templates

Regfo employs approximately ten core prompt templates, each engineered for specific compliance tasks. Unlike generic RAG implementations that retrieve arbitrary context, Regfo's retrieval system is regulatory-aware.

When generating a clinical trial protocol, the system does not simply retrieve "relevant" documents. It follows a structured retrieval hierarchy: first accessing applicable FDA guidance documents, then ICH harmonized guidelines, then historical approval precedents for similar indications, then current enforcement trends from warning letters and consent decrees.

Each template enforces output structures that match regulatory expectations. A pre-IND meeting request generated by Regfo follows FDA formatting requirements precisely, including the expected table structures, question formats, and supporting documentation organization that expedite agency review.

Cryptographic Evidence Mapping

Every Regfo output includes cryptographic links to source regulatory documents. When the system recommends a specific patient exclusion criterion, the recommendation includes verifiable references to the FDA guidance documents, precedent approvals, and safety databases that informed the decision.

This evidence mapping serves two purposes. First, it enables immediate auditor verification. An FDA inspector can trace any protocol decision to its regulatory justification within seconds. Second, it provides institutional memory. When regulations change, the system identifies all previous outputs that referenced the modified guidance and flags them for review.

First Comply, Then UI

Regfo inverts the typical software development approach. Most compliance tools start with user interfaces and add compliance features. Regfo starts with regulatory validity and builds interfaces around compliant workflows.

This philosophy manifests in the platform's architecture. Users cannot take actions that would produce non-compliant outputs. The system does not warn about potential compliance violations; it prevents them structurally. A clinical trial designer cannot specify a patient population that violates FDA inclusion criteria because the interface does not permit such specifications.

Technical Deep Dive: How AI Agents Work for Compliance

Regfo deploys specialized AI agents for distinct compliance functions. Unlike monolithic AI systems, this agent architecture allows each component to be optimized, validated, and audited independently.

The Regulatory Monitor Agent

This agent continuously scans global regulatory sources, identifying changes relevant to ongoing projects. When the FDA updates guidance on decentralized clinical trials, the agent identifies all active studies that may be affected, categorizes the changes by impact severity, and initiates appropriate review workflows.

The monitoring extends beyond official publications. The agent tracks enforcement actions, warning letters, consent decrees, and advisory committee discussions to identify emerging regulatory expectations before they become formal requirements.

The Document Analysis Agent

Specialized for regulatory document understanding, this agent employs domain-specific fine-tuning on millions of regulatory documents, clinical trial protocols, drug approval packages, and compliance correspondence.

The fine-tuning approach follows best practices established in recent research: starting with an instruction-tuned base model and further training on regulatory Q&A pairs. This method requires less training data than fine-tuning raw models while achieving superior domain performance.

Critically, the document analysis agent maintains uncertainty quantification. When encountering novel regulatory scenarios without clear precedent, the agent explicitly flags uncertainty rather than generating confident but unreliable guidance.

The Evidence Assembly Agent

When compliance documentation is required, the evidence assembly agent constructs complete packages with full traceability. For an FDA submission, this includes assembling referenced documents, verifying citation accuracy, checking for regulatory currency, and formatting outputs to agency specifications.

The agent also performs completeness validation, comparing assembled packages against regulatory checklists and flagging missing elements before submission.

The Orchestration Layer

Regfo's CI/CD orchestration layer coordinates agent activities and manages compliance workflows. This layer implements the "shift left" principle for compliance: integrating regulatory validation at the earliest possible stages of product development.

When a pharmaceutical company begins preclinical research, the orchestration layer initiates regulatory pathway analysis, identifies potential clinical development challenges, and establishes monitoring for relevant regulatory changes. Compliance becomes a continuous process rather than a final hurdle.

Use Cases: Compliance Automation in Practice

Pharmaceutical: Clinical Trial Design Automation

A mid-size biotech company is developing a novel oncology therapeutic. Traditional approaches would involve months of regulatory strategy development, followed by protocol drafting, followed by regulatory review, followed by revisions.

With Regfo, the process transforms. The Study Design Wizard analyzes the therapeutic mechanism, reviews precedent approvals for similar indications, and identifies the optimal regulatory pathway. It generates IND-ready protocol sections with appropriate endpoints, inclusion criteria, and safety monitoring plans.

The Proactive Red-Flag module identifies potential regulatory concerns before they become problems. If the proposed dosing schedule differs from approved comparators, the system flags this deviation and provides regulatory precedent for the chosen approach or recommends adjustment.

Total time from concept to IND-ready protocol: weeks instead of months.

Banking: Policy and Workflow Compliance

A regional bank faces an upcoming examination and must demonstrate compliance across AML, BSA, and consumer protection requirements. Compliance officers currently spend weeks manually mapping policies to regulatory requirements and assembling evidence of operational adherence.

Regfo's Policy and Workflow Wizard automates this mapping. The system ingests current policies, identifies gaps relative to regulatory requirements, and generates specific remediation recommendations with implementation timelines.

The Audit-Ready Reporting module continuously assembles examination packages, maintaining current evidence of compliance controls and operational adherence. When examiners arrive, documentation is complete and traceable.

Risk Monitoring provides ongoing surveillance of customer activities, applying regulatory thresholds and generating appropriate alerts while filtering noise that creates alert fatigue.

Healthcare: HIPAA Compliance Monitoring

A healthcare system manages protected health information across dozens of facilities and hundreds of applications. HIPAA compliance requires continuous monitoring of access controls, encryption status, business associate agreements, and breach detection systems.

Regfo integrates with existing healthcare IT infrastructure to provide continuous compliance monitoring. When a new application is deployed, the system automatically assesses HIPAA implications and identifies required safeguards. When workforce changes occur, access control reviews are automatically initiated.

The 2024 healthcare breach statistics are sobering: 725 large data breaches affected 275 million records, representing 82% of the US population. Continuous monitoring catches configuration drift and access anomalies before they become breach notifications.

Compliance Standards Coverage

Regfo provides comprehensive coverage across major regulatory frameworks. Each framework requires specific knowledge bases, validation rules, and output formats.

FDA and ICH Guidelines

For pharmaceutical and medical device companies, Regfo maintains current knowledge of FDA guidance documents, ICH harmonized guidelines, and Center-specific requirements. The platform supports pre-IND meeting preparation, IND submissions, NDA/BLA documentation, and post-market compliance monitoring.

The system tracks FDA enforcement trends, identifying emerging compliance expectations from warning letters and consent decrees before they become formal guidance.

HIPAA

Healthcare compliance requires continuous monitoring of the Privacy Rule, Security Rule, and Breach Notification Rule. Regfo automates risk assessments, maintains Business Associate Agreement tracking, and monitors access controls across covered entities and business associates.

The platform generates documentation required for OCR audits and supports breach response workflows including notification timeline management.

SOC 2

For technology companies, SOC 2 compliance demonstrates security control effectiveness. Regfo automates evidence collection across the five trust service criteria: security, availability, processing integrity, confidentiality, and privacy.

The platform integrates with cloud infrastructure and development tools to provide continuous control monitoring, automatically detecting drift from compliant configurations and initiating remediation workflows.

GDPR and CCPA

Privacy regulations require documented data processing activities, consent management, and data subject rights fulfillment. Regfo maintains processing activity records, automates data subject request workflows, and monitors for regulatory developments affecting privacy obligations.

AML and KYC

Financial institutions must maintain robust anti-money laundering programs including customer due diligence, transaction monitoring, and suspicious activity reporting. Regfo automates customer risk assessments, monitors transactions against regulatory thresholds, and generates SAR documentation with complete evidentiary support.

Support and Monitoring: Proactive Compliance Management

Compliance is not a destination; it is a continuous state requiring constant vigilance. Regfo provides the monitoring and alerting infrastructure to maintain compliance over time.

Proactive Red-Flag Detection

The platform continuously monitors for conditions that may indicate emerging compliance risks. Changes in regulatory guidance, enforcement trends, or operational patterns trigger proactive alerts before violations occur.

For pharmaceutical companies, this includes monitoring competitor regulatory actions that may signal agency priorities. For financial institutions, this includes surveillance of enforcement actions that may indicate examination focus areas.

Alert Escalation Workflows

When potential compliance issues are detected, Regfo routes alerts through appropriate escalation paths based on severity and organizational structure. Critical issues reach senior compliance officers immediately; routine matters enter standard review workflows.

Alert fatigue is actively managed through intelligent filtering and prioritization. The system learns organizational risk tolerances and adjusts alert thresholds accordingly.

Compliance Dashboards

Executive dashboards provide real-time visibility into compliance status across the organization. Risk heat maps identify areas requiring attention. Trend analysis reveals improving or deteriorating compliance postures. Regulatory calendars track upcoming obligations and deadlines.

These dashboards support board-level reporting requirements, providing the documentation necessary to demonstrate compliance program effectiveness to regulators and stakeholders.

The Competitive Landscape: Why Regfo Wins

The compliance technology market includes established players and emerging AI entrants. Regfo's competitive position derives from its unique combination of specialist knowledge, full auditability, and proactive design integration.

Versus Generic AI (ChatGPT, Claude, Gemini)

General-purpose AI models cannot provide the traceability, auditability, and regulatory-grade reliability that compliance requires. They lack real-time regulatory data access, cryptographic evidence mapping, and domain-specific validation. For conversational assistance, they excel. For regulatory compliance, they create liability.

Versus Legacy Consulting

Traditional compliance consulting relies on manual review by human experts. This approach cannot scale, cannot provide continuous monitoring, and cannot integrate compliance into operational workflows. Consulting engagements produce point-in-time assessments; Regfo provides continuous compliance assurance.

Versus Checklist-Based Software

Existing compliance software typically implements checklist-based approaches: documenting that required activities occurred without assessing whether those activities actually achieve compliance objectives. Regfo's generative approach evaluates substantive compliance, identifying not just whether a policy exists but whether it adequately addresses regulatory requirements.

Implementation: Getting Started with Regfo

Organizations typically implement Regfo in phases, beginning with highest-risk compliance areas and expanding coverage over time.

Phase 1 (Weeks 1-4): Core compliance monitoring deployment. Integration with existing document repositories and regulatory calendars. Initial risk assessment and gap analysis.

Phase 2 (Weeks 5-8): Full workflow integration. Deployment of domain-specific agents for primary compliance functions. Staff training and change management.

Phase 3 (Ongoing): Continuous optimization. Expansion to additional compliance domains. Performance tuning based on organizational learning.

Most organizations achieve measurable compliance improvements within the first month of deployment. Full return on investment typically occurs within six months through reduced compliance staff burden, faster regulatory submissions, and avoided violations.

Conclusion: Compliance as Competitive Advantage

The $100 billion compliance bottleneck is not inevitable. Organizations that transform compliance from a cost center to a strategic capability will outpace competitors who remain trapped in manual, reactive approaches.

Regfo makes this transformation possible. By integrating AI agents purpose-built for regulatory compliance, maintaining cryptographic auditability, and shifting compliance left into operational workflows, Regfo delivers what generic AI cannot: regulatory-grade reliability at scale.

The pharmaceutical companies that bring drugs to market faster. The banks that onboard customers without friction. The healthcare systems that protect patient data while enabling innovation. These are the organizations that will thrive in the regulatory environment of 2026 and beyond.

The question is not whether AI will transform compliance. The question is whether your organization will lead that transformation or be disrupted by it.

Explore how The BrightByte can help you implement Regfo and transform your compliance operations.

![Custom Software Development Rates by Country [2024]](/assets/images/expertise/it_service/generative-ai-services-hero-banner.webp)